arkansas estate tax return

AR1000TC Schedule of Tax Credits and Business Incentive Credits. 6081 as amended and in effect on January 1 2002 shall be granted an extension of time in which to file the Arkansas estate tax return for the same period of time as granted for the filing of the federal estate tax return.

Knowing About Electrical Wires In Northwest Arkansas And What They Do Can Be Very Important At Davitt Electric We Want To Help You M Home Home Security House

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

. Little Rock AR 72203-1000. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Start filing for free online now. One reason is to lock in the date of death for determining the fair market values of the estate assets.

AR4FID Fiduciary Interest and Dividends. 26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar property at the. AR1000RC5 Individuals With Developmental Disabilites Certificate.

There may be a situation where filing an estate tax return is still a good idea even though the estate is not required to pay any taxes. To check the status of your Arkansas state refund online navigate here. As of January 1 2005 Arkansas no longer imposes an estate tax.

AR1002-TC Fiduciary Schedule of Tax Credits and Business Incentive Credits. Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and eFile a AR state return.

Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. Lincoln County Courthouse 300 South Drew Street Star City AR 71667 870 628-4147 State Services in Your Area Link to these helpful services offered by the State of Arkansas. AR1000NR Part Year or Non-Resident Individual Income Tax Return.

Ad Over 85 million taxes filed with TaxAct. Market Value - ACA. Enter your SSN Enter your refund amount from your tax return Click on Submit and you be taken to the refund information.

Pay-by-Phone IVR 1-866-257-2055. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals. You also may check the status of your refund by calling 1 501 682-1100 or toll free at 800 882-9275.

AR1000-OD Organ Donor Donation. Check your refund status at. Personal Property - Under Arkansas law ACA.

These additional measures may result in tax refunds not being issued as quickly as in past years. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. Most of the states in the United States do not charge estate tax.

Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files. Online payments are available for most counties. The tax is item 10 on the Arkansas Estate Tax Return Form.

There are two kinds of taxes owed by an estate. AR1002F Fiduciary Income Tax Return. Arkansas State Income Tax.

E-filed Returns - Payment Due. The Arkansas tax filing and tax payment deadline is April 18 2022. Find IRS or Federal Tax Return deadline details.

This means that estates in Arkansas do not owe any estate tax to state agencies. AR1002NR Non-Resident Fiduciary Income Tax Return. A Any person who requests and receives an extension of time in which to file a federal estate tax return as provided by 26 USC.

If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. IDENTIFICATION Date of Death Decedents SSN Estate Tax Return Due Date Decedents First Name and Middle Initial Decedents Last Name. AR1000F Full Year Resident Individual Income Tax Return.

The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. No Tax DueRefund Return. Income Tax Administration IndividualIncomedfaarkansasgov Ledbetter Building 1816 W 7th St Rm 2220 Little Rock AR 72201 Mailing Address.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Little Rock AR 72203-8026. Arkansas State Income Tax.

Arkansas is one of them. Filing your taxes just became easier. Arkansas State Income Taxes for Tax Year 2021 January 1 - Dec.

This page contains basic information to help you. File your taxes stress-free online with TaxAct. The statewide property tax deadline is October 15.

STATE OF ARKANSAS Estate Tax Return AR321 2002 FOR OFFICE USE ONLY Due Date _____ Date Recd_____ A copy of the Federal return will be acceptable in lieu of this return and should be filed with the State of Arkansas Department of Finance and Administration nine 9 months after the date of the decedents death unless an extension of time. If mailing a payment for a tax return that has been electronically filed complete Form AR1000V and include a check or money order. If you own property in Arkansas and your beneficiaries inherit your property they will not owe any estate tax to the state.

One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. PO Box 8110 Little Rock AR 72203. In all instances of estates required to file a Federal Return with assets totally or in part in Arkansas an Arkansas Estat e Tax Return shall be filed with the Director of the Department of Finance and Administration nine 9 months after the date of the decedents death.

One 1 copy of the approved request must be attached to the return when filed. Arkansas - Department of Finance and Administration. Be sure to pay before then to avoid late penalties.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

According To The Stanford Center On Longevity Most Individuals Underestimate Their Personal Longevity A Key Reason Peo Happy Retirement Life Expectancy Live

30 Day Notice To Vacate Pdf Rental Property Management Property Management Real Estate Investing Rental Property

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Arkansas Excise Tax Return Et 1 Form Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In Arkansas Taxvalet

American Opportunity Tax Credit H R Block

S Corp Tax Return How To File An S Corp Tax Return Truic

How To File And Pay Sales Tax In Arkansas Taxvalet

How To File And Pay Sales Tax In Arkansas Taxvalet

Estate Lawyer California Estate Services And Litigation Attorneys Keystone Law Group Medical Malpractice Lawyers Criminal Defense Attorney Litigation Lawyer

Federal Income Tax Deadline In 2022 Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

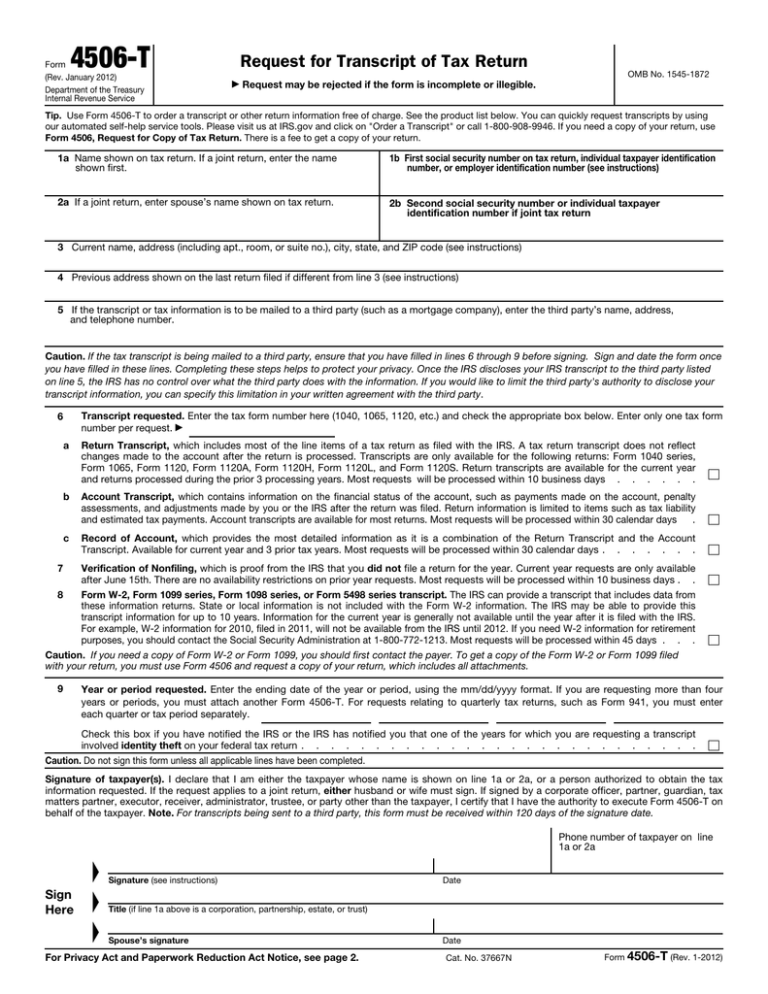

4506 T Request For Transcript Of Tax Return

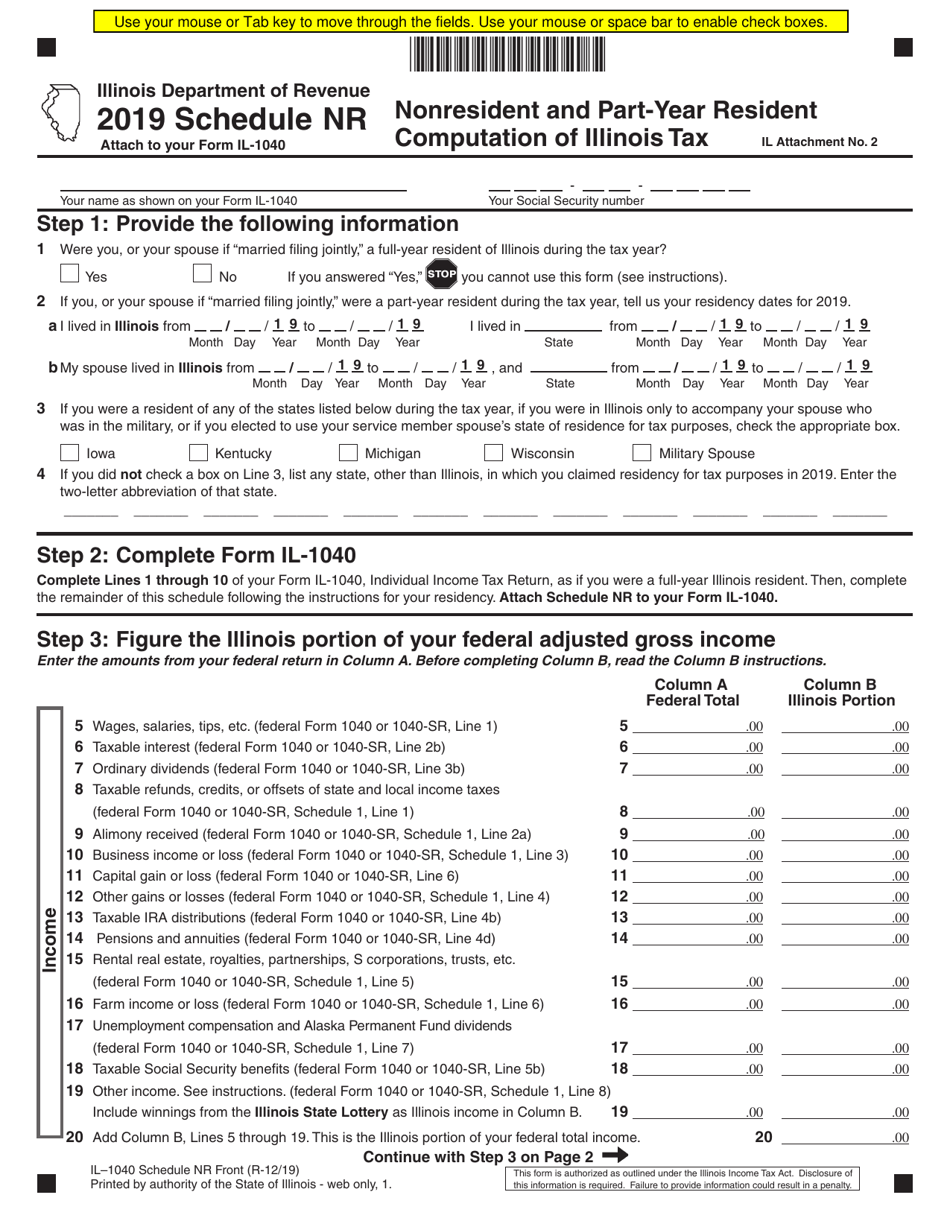

Form Il 1040 Schedule Nr Download Fillable Pdf Or Fill Online Nonresident And Part Year Resident Computation Of Illinois Tax Illinois Templateroller