are assisted living expenses tax deductible in canada

Chronically ill residents need to be considered to qualify for tax deductions for assisted living expenses. The federal and Ontario governments have tax credits available to taxpayers including those paid for medical expenses.

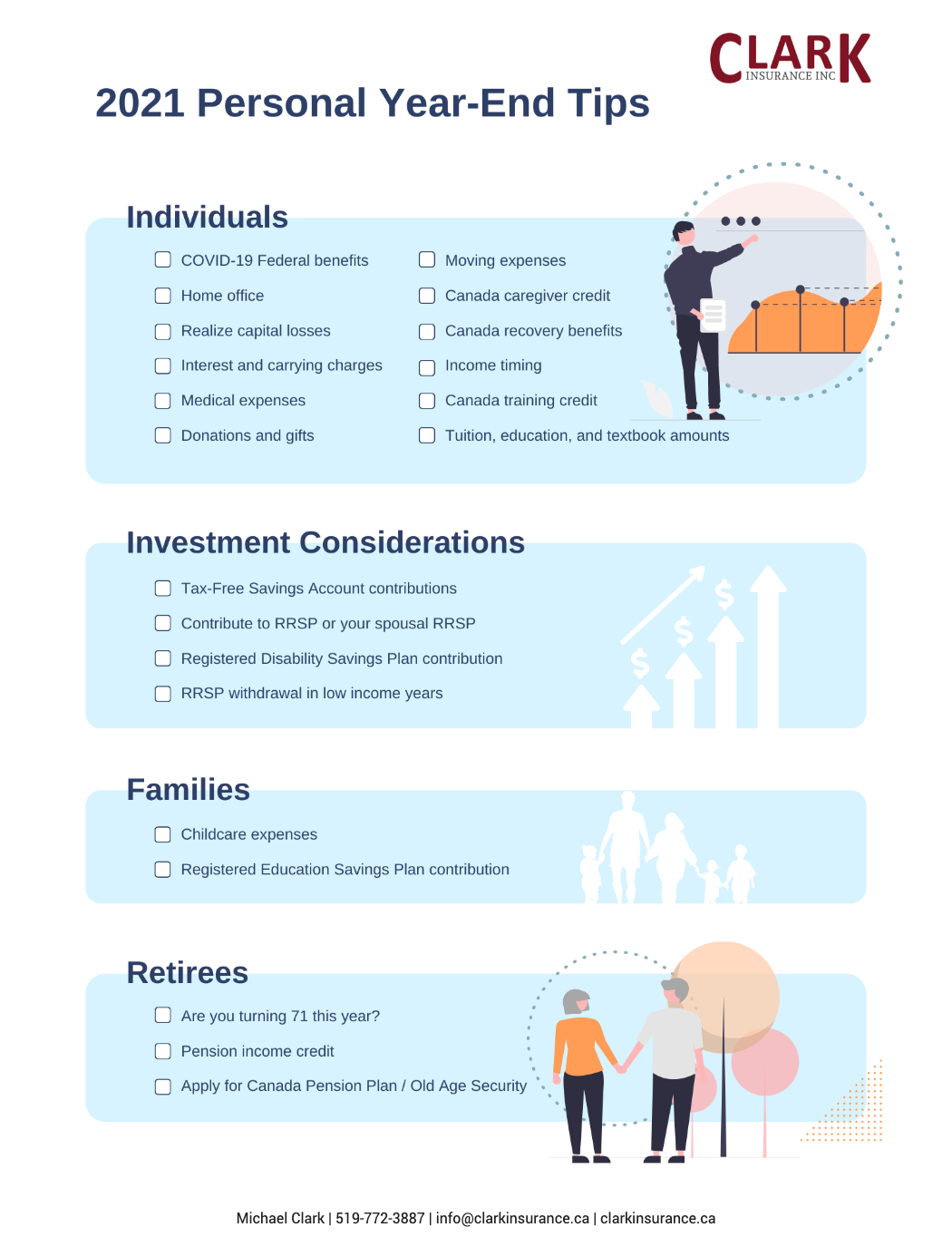

2021 Personal Year End Tax Tips Clark Insurance

In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

-Michael-Clark-Aew3RKYm6cxZF5ggh.png)

. The assisted living facility provides him the custodial care he needs. An expenses that exceed 7 percent of total income qualifies for an IRS deduction. Some or all of your medical expenses related to assisted living are deductible to a certain extent depending on whether or not your loved one lives in an assisted living community.

Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. A medical expense tax deduction can be claimed by either you or your loved one in an assisted living community if one-quarter or all or all of your assisted living costs are included in your income.

All medical expenses exceeding a maximum of 7500 must be reported to the Internal Revenue Service. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. The trick is to determine if Moms assisted living facility costs qualify as expenses for medical care Clearly nursing home expenses are deductible but assisted living is a bit less certain.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. Yes in certain instances nursing home expenses are deductible medical expenses.

No Tax Knowledge Needed. An individual must count any medical expenses that make up at least 7 percent of his or her income. Yes medical expenses in excess of 10 of gross annual income may be deducted from your income taxes.

For information on claiming attendant care and the disability amount see the chart. When the medical expenses of a loved one you or live with in an assisted living community are deducted it may include a significant amount of your overall assisted living costs. For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction.

For the tax year 2019 any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted. Medical expenses are generally excluded under this category from IRS income taxes if they exceed 7 percent of total taxable income. METC claims depend on several factors including the kind of facility you reside in.

To calculate your total medical expense tax deduction start by determining your qualifying assisted living. The Medical Expense Tax Credit METC can be claimed for costs associated with nursing and retirement homes that are paid by you or your spouse. If youre 70 and over paying your taxes and renting a private seniors residence Quebec grants the Senior Assistance Tax Credit as a basic amount for up to 70 of your rent costs.

Are assisted living expenses tax deductible in Canada. Has been certified by medical staff either that the resident can no longer commit more than two activities per day in order to live such as eating toileting transferring bath. Assisted living expenses qualify as deductible medical expenses when the resident is chronically ill and care is provided according to an established plan prescribed by a licensed healthcare provider.

Are Assisted Living Expenses Tax-Deductible Irs. Special rules when claiming the disability amount. If the cost goes over 75 which would be 3375 a year for this example then amounts over this number would be deductible.

Answer Simple Questions About Your Life And We Do The Rest. Back to Mom and Dad and their potential whopping tax bill. A deduction of five percent of an individuals adjusted gross income can be taken.

This amount gets bumped up to a maximum of 80 if youre a dependent and also requires you to have not been confined in jail for more than 183 days during the tax year. You can also see the examples. Tax deductions up to 5 of an individuals adjusted.

Certain conditions that must be met to qualify. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. He paid the assisted living facility 45000 in 2019.

To qualify for cost-of-living deductions there must be a plan of care prepared listing all of the services that the resident will receive to qualify for the deduction. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A. When you have lived in an assisted living community for three months or longer some or all of your assisted living expenses may be eligible for a medical expense tax deduction.

In order for assisted living expenses to be tax deductible the resident must be considered chronically ill. Medical costs such as assisted living that is not provided for by insurance or any other source may be deductible. There are special rules when claiming the disability amount and attendant care as medical expenses.

Can You Claim Assisted Living Expenses On Taxes. Qualifying medical expenses that make up more than 75 of the residents adjusted gross income can be deducted. How Assisted Living Expenses Become Tax Deductibile.

The entire 45000 qualifies as a medical expense and is deductible on Roberts tax return subject to the AGI limitation. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Those whose medical expenses exceed 7 percent of their income qualify for tax relief.

You can deduct part or all of your assisted living expenses on your personal tax return if your loved one is living in one of the communities. Calculate your net federal tax by completing Step 5 of your tax return to find out what is more beneficial for you. File With Confidence Today.

Qualified long-term care services have been defined as including the type of daily personal care services provided to Assisted Living residents such as help with bathing dressing continence.

Are Long Term Care Expenses Tax Deductible In Canada Ictsd Org

A Huge Benefit Of A Homebusiness And Networkmarketing Is The Tax Writeoffs You Receive Accounting Humor Taxes Humor Maxine

Claiming Attendant Home Care Expenses All About Seniors

-Michael-Clark-Aew3RKYm6cxZF5ggh.png)

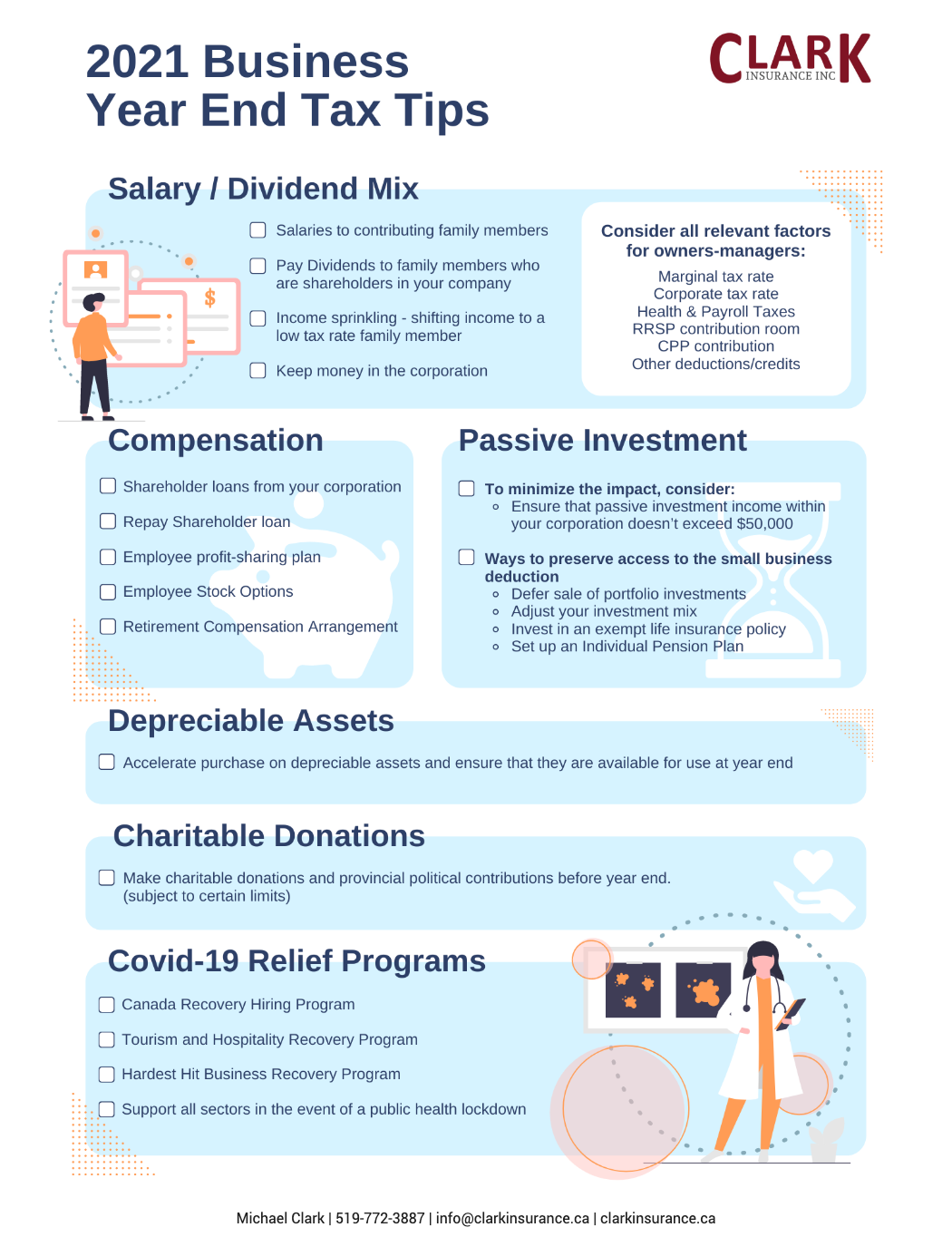

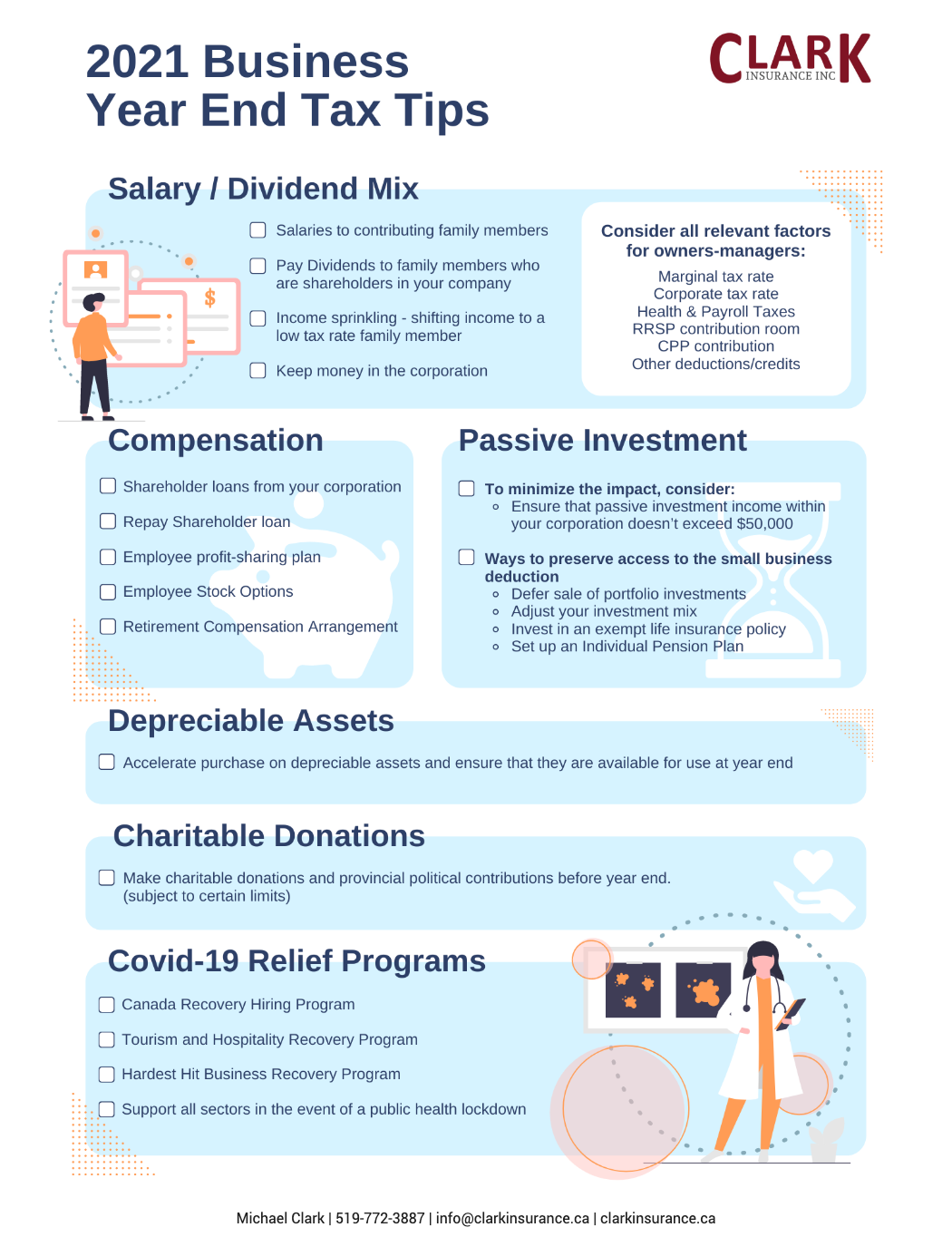

2021 Year End Tax Tips For Business Owners Clark Insurance

What Medical Expenses Are Tax Deductible In Canada Cubetoronto Com

What Tax Deductions Are Available For Assisted Living Expenses

Can You Claim Nursing Home Expenses On Taxes In Canada Ictsd Org

Explore Our Free Dependent Care Fsa Nanny Receipt Template Receipt Template Bank Statement Templates

H R Block Review 2022 Pros And Cons

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Disability Tax Credit The Ultimate Guide Graphene Group Accounting

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

It S Tax Time Important Information For Seniors To Consider

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

Are Long Term Care Costs Tax Deductible In Canada Ictsd Org